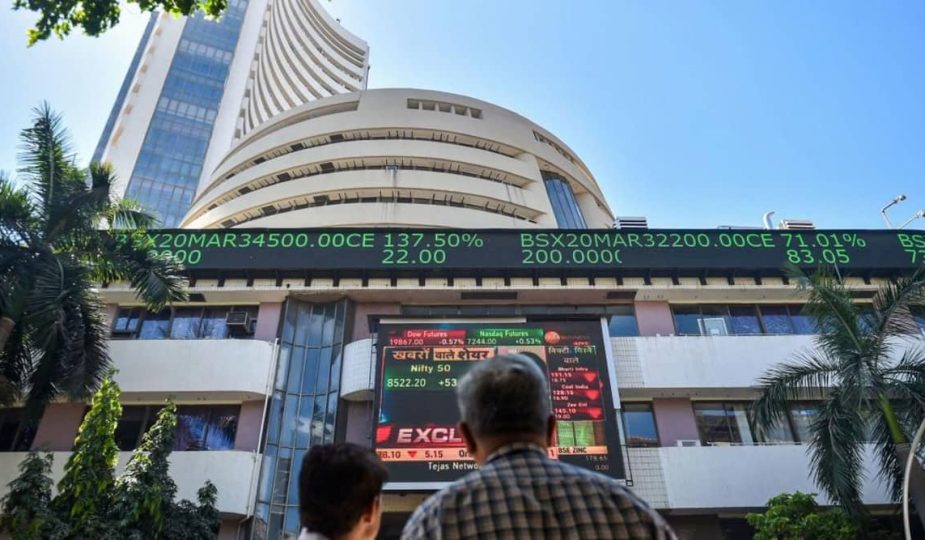

Share Market Highlights: Sensex ends 465 pts higher; Nifty above 17500; Reliance, HDFC twins lead gains

Share Market News Today | Sensex, Nifty, Share Prices Highlights: Indian equity markets ended higher on Monday, supported by index heavyweights like Reliance Industries, HDFC Bank, Bajaj Finance and Maruti Suzuki. The BSE Sensex ended 465 points or 0.80% up at 58,853, while NSE Nifty 50 settled 127 points or 0.73% higher at 17,525. Indian rupee ended lower by 19 paise at 79.65 per dollar against Friday’s close of 79.24. In the broader markets, the BSE MidCap and SmallCap indices edged 0.3% higher each. Sectorally, the Nifty PSU Bank index slipped 0.4%, followed by the Nifty IT index (down 0.02%). All other indices clocked gains.

Live Updates

Live Updates

Share Market Today | Sensex, Nifty, BSE, NSE, Share Prices, Stock Market News Live Updates 8 August Monday

15:39 (IST) 8 Aug 2022 Nifty, Sensex end higher; RIL and HDFC twins lead gains

Indian equity markets ended higher on Monday, supported by index heavyweights like Reliance Industries, HDFC Bank, Bajaj Finance and Maruti Suzuki. The BSE Sensex ended 465 points or 0.80% up at 58,853, while NSE Nifty 50 settled 127 points or 0.73% higher at 17,525.

15:23 (IST) 8 Aug 2022 Rupee to trade on a negative note on strong Dollar and geopolitical tensions

“Indian rupee depreciated on positive Dollar and recovery in crude oil prices. However, positive domestic markets and FII inflows cushioned the downside. FII inflows on Friday stood at Rs. 1.605 crores. US Dollar surged on upbeat jobs data. US Non-Farm Payrolls added 5,28,000 jobs in July compared to 3,98,000 jobs in June and expectations of 2,50,00. US unemployment rate declined to 3.5% in July compared to 3.6% jobs in June. Employment in US back to pre-covid levels. We expect Rupee to trade on a negative note on strong Dollar and geopolitical tensions as China escalated military drills over Vietnam. Strong jobs data may be positive for US Dollar is it raises expectations of an aggressive rate hike by Federal Reserve. However, foreign fund flows may support Rupee at lower levels. USDINR spot price is expected to trade in a range of Rs 78.50 to Rs 80.50 in next couple of sessions.”

~Anuj Choudhary – Research Analyst, Sharekhan by BNP Paribas

15:01 (IST) 8 Aug 2022 Stocks to buy: IGL, 2 other gas shares well placed on technical charts, buy for 21% upside

Domestic stock markets have begun the week with gains as Sensex and Nifty 50 rose higher on Monday. S&P BSE Sensex was up 0.70% to sit at 58,800 while the NSE Nifty 50 index was comfortably above 17,500. Meanwhile, India VIX, was up in the green, breaching 19 levels. Some analysts have now started questioning the valuations of domestic markets after the recent rally since Foreign Institutional Investors started pumping in money. A stock-specific strategy is something that many would advise in such a scenario. Chartists at Prabhudas Lilladher have narrowed down three gas stocks that they believe could help investors pocket gains.

Read full story

14:54 (IST) 8 Aug 2022 Anand Rathi on Birlasoft

“Birlasoft’s $148.6m revenue (up 1.5% q/q, 16% y/y) was in line with the industry though it faced delays in ramp-ups of two deals. New TCV ($112m, TTM up 7% y/y) held up well despite the company’s greater exposure to discretionary sectors/service lines. The 14.7% EBITDA margin was down 127bps y/y on lower utilisation and higher onsite work. Headcount addition inched up q/q and attrition cooled. Slight cut to our estimates, with new target of Rs445 (19x FY24), a ~40% discount to LTI. Retaining a Buy”

~Anand Rathi Share and Stock Brokers

14:52 (IST) 8 Aug 2022 Crude oil supply remains tight from the OPEC members

WTI crude oil prices starts sluggish for the new week and is trading around $88.30 down 0.8% during morning European session, following a 10% weekly decline for the week ending August 5. The overnight trade data from China showed imports of oil rose mere 0.9% to 8.83mbpd in July from 47 months low level of June amid destocking activity and slow domestic demand recovery. Last week the US job market posted robust hiring number of 528K for July, signalling strong chance of US economy avoiding the recession but not the slowdown. US market has now fully restored jobs to the pre-pandemic level. However Gasoline demand surprisingly remains weak during the peak summer driving season in US despite continuous decline in gasoline prices at pumps. Supply remains tight from the OPEC members amid limited spare capacity, which remains the biggest support for higher crude oil price forecast. For the day prices are likely to remain sideways to lower bias amid lack of economic data, WTI holds strong support at $85 while upside rally to face resistance at $92-$94.

~Mohammed Imran, Research Analyst, Sharekhan by BNP Paribas

14:49 (IST) 8 Aug 2022 Bajaj Finserv hits over 3-month high; stock zooms 30% in a month

Bajaj Finserv shares hit over three-month high of Rs 15,584, up 3 per cent on the BSE. The stock extended its gain after the company approved 1:1 bonus issue and 1:5 stock split in July.

14:48 (IST) 8 Aug 2022 Adani Ports Q1

Net profit went down 18% at Rs 1,072.4 crore against Rs 1,307 crore (YoY).

Revenue was up 20.6% at Rs 4,638 crore against Rs 3,845 crore (YoY).

EBITDA was down 31% at Rs 1,809 crore against Rs 2,620 crore (YoY).

Margin at 38.9% against 57.5% (YoY).

14:24 (IST) 8 Aug 2022 Nifty, Sensex holding firm gains

Benchmark indices extended the gains and trading at day’s high level. The Sensex was up 497.70 points or 0.85% at 58885.63, and the Nifty was up 137.10 points or 0.79% at 17534.60.

14:23 (IST) 8 Aug 2022 HDFC Bank, IDFC First Bank hike MCLR

HDFC Bank has raised its marginal cost of funds-based lending rate (MCLR) by 5 – 10 basis points (bps) across loan tenors, with effect from August 8. IDFC First Bank has also revised its MCLR upwards by 5-15 bps across loan tenors, The interest rate hike comes after the six-member monetary policy committee (MPC) hiked the benchmark repo rate by another 50 bps to 5.40 per cent last week.

14:21 (IST) 8 Aug 2022 BSE 500 top losers

Zensar Technologies down nearly 8 per cent is the top loser among the BSE 500 stocks so far. It is followed by Sudarshan Chemicals, Shipping Corporation of India, Brightcom Group and HPCL.

14:20 (IST) 8 Aug 2022 Oil prices bounces higher as China, US data ease recession concerns

Brent crude futures had risen 81 cents, or 0.9%, to $95.73 a barrel by 0638 GMT. U.S. West Texas Intermediate crude was at $89.76 a barrel, up 75 cents, or 0.8%

14:18 (IST) 8 Aug 2022 Nykaa share price down 44% from life-time high; should you buy, hold or sell?

Nykaa share price rose on Monday after the internet company reported 33% on-year rise in consolidated net profit to Rs 4.55 crore in quarter ended 30 June 2022, as against net profit of Rs 3.42 crore in Q1FY22. (FSN E-Commerce Ventures) Nykaa’s revenue from operations jumped 41% on-year to Rs 1,148.42 crore in Q1FY23. While the stock has risen 1.5% in the last one month, Nykaa shares are still down 44% from its life-time high of Rs 2,573.70, hit on 26 November 2021. Despite the strong performance in April-June quarter, analysts remain sceptical and have mixed views on the stock. Nykaa shares were quoting at Rs Rs 1,414 apiece, up 1.31% on NSE intraday.

Read full story

13:49 (IST) 8 Aug 2022 BSE 500 top gainers

Hindustan Aeronautics and JSW Energy have zoomed over 7 per cent each and were the top gainers among the BSE 500 stocks so far. Aegis Logistics, BASF India and Paytm were some of the other major gainers

13:48 (IST) 8 Aug 2022 Nifty Bank up 1%

Nifty Bank index rose nearly 1 per cent led by the IDFC First Bank, HDFC Bank, Axis Bank

13:19 (IST) 8 Aug 2022 Indian Overseas Bank Q1 Results

Indian Overseas Bank reported 20% on-year growth in standalone profit at Rs 392.2 crore for the quarter ended June FY23 quarter supported by lower provisions. Net interest income grew by 17.2% YoY to Rs 1,753.8 crore for the June FY23 quarter. Indian Overseas Bank was quoting at Rs 17.85, up Rs 0.05, or 0.28 percent on the BSE.

13:10 (IST) 8 Aug 2022 Auto stocks see buying

BSE Auto index rose 0.7 percent led by the UNO Media, M&M, TI Industries

13:10 (IST) 8 Aug 2022 Indices at day’s high

Benchmark indices were trading at day’s high with Nifty above 17500. The Sensex was up 478.11 points or 0.82% at 58866.04, and the Nifty was up 129 points or 0.74% at 17526.50.

12:50 (IST) 8 Aug 2022 Metal stocks gain

Nifty Metal index added 1 percent led by the Welspun Corp, Hindalco, Adani Enterprises

12:41 (IST) 8 Aug 2022 HAL, TVS Motor Company among 115 stocks to hit 52-week high on BSE, 34 scrips touch fresh lows

Abirami Financial Services, Andhra Paper, Aditya Vision, Bhagiradha Chemicals & Industries, CSL Finance, Easy Fincorp, Finotex Chemical, Gensol Engineering, Grindwell Norton, Hindustan Aeronautics, Kaycee Industries, Lemon Tree Hotels, Vedant Fashions, Metro Brands, The Pheonix Mills, Rama Steel Tubes, Sanmit Infra, Tata Elxsi, TVS Motor Co, Welspun Enterprises were among the stocks that hit 52-week high on BSE intraday. Meanwhile Alembic Pharma, Birla Tyres, Coral Laboratories, Future Retail, Jetmall Spices and Masala, Kwality Pharmaceuticals, Majestic Research Services and Solutions were among scrips at fresh lows.

Read full story

12:09 (IST) 8 Aug 2022 Indices hold gains

Benchmark indices were holding on the gains with Nifty around 17450. The Sensex was up 289.35 points or 0.50% at 58677.28, and the Nifty was up 76 points or 0.44% at 17473.50.

11:54 (IST) 8 Aug 2022 RIL’s green energy biz will outshine other segments in 5-7 years: Mukesh Ambani

Reliance Industries (RIL) sees its green energy business emerging as a growth engine for the company in the next 5-7 years, Chairman and Managing Director Mukesh Ambani told shareholders in the company’s annual report for 2021-22 (FY22). Reliance had last year announced a Rs 75,000-crore investment over three years as part of its new energy push. RIL led gains on Sensex in intraday trade.

11:47 (IST) 8 Aug 2022 BPCL share price tumbles as firm reports losses in Q1; analysts mixed on outlook, check target price

Bharat Petroleum Corporation Ltd (BPCL) share price tumbled 4.75% on Monday, days after the company reported a net loss of Rs 6,291 crore in the first quarter of the current fiscal year. Analysts noted that the loss reported by the company was owing to retail fuel prices being kept frozen leading to marketing loss. The stock was trading at a low of Rs 320 per share on Monday, extending its 16% decline so far this year. However, analysts are mixed in their outlook for BPCL despite the loss. While some are advising investors to give up and sell the stock some are still bullish on the scrip.

Read full story

11:46 (IST) 8 Aug 2022 Tata Motors shares marginally up

Tata Motors Sunday said its subsidiary Tata Passenger Electric Mobility Ltd (TPEML) has signed a Unit Transfer Agreement (UTA) for the acquisition of Ford India’s manufacturing plant at Sanand in Gujarat for Rs 725.7 crore. As part of the agreement, Tata Motors will get entire land and buildings, vehicle manufacturing plant along with machinery and equipment situated therein, the Mumbai-based auto major said in a late-night notification to the stock exchanges. Ford India will continue to operate its powertrain manufacturing facility by leasing back the land and buildings of the powertrain manufacturing plant from Tata Passenger Electric Mobility on mutually agreed terms, Tata Motors said.

11:39 (IST) 8 Aug 2022 Global cues mixed

Asian markets turn mixed; Hong Kong’s Hang Seng index extends fall

11:38 (IST) 8 Aug 2022 Nifty technical view

Nifty likely to find support at around 17160 while 17500 is likely to act as resistance on the upside. Bank Nifty likely to find support at 37400 while 38200 is likely to act as resistance.

~IIFL Securities

11:35 (IST) 8 Aug 2022 Weekly Technical Picks: Axis Securities

– BASF India Limited has a buy at range 2900 – 2842. Holding period is 3 to 4 weeks.

– Oracle Financial Services Software Limited has a buy at range 3360 – 3294. Holding period is 3 to 4 weeks.

– IRB Infrastructure Developers Limited has a buy at range 245 – 240. Holding period is 3 to 4 weeks.

– ICICI Prudential Life Insurance Company Limited has a buy at range 570 – 560. Holding period is 3 to 4 weeks.

11:33 (IST) 8 Aug 2022 Gas stocks to buy: Prabhudas Lilladher

Mahanagar Gas Ltd (MGL): BUY

The stock has witnessed a decent pullback from the support zone of 670 levels and moving above the significant 50EMA level of 768 has shown prominent strength with upside movement anticipated in the coming days. With the chart looking attractive, we suggest to buy this stock for an upside target 980 keeping the stop loss of 740.

Indraprastha Gas (IGL): BUY

The stock has maintained the support zone near the trendline support of 343 levels and witnessing a consolidation phase with improvement in the indicators. We suggest to buy and accumulate this stock for an upside target of 410 keeping the stop loss near 330 levels.

GUJ GAS: BUY

The stock has taken support near the trendline zone of 400 levels and indicated a decent pullback to witness some consolidation near 440-450 zone with overall trend remaining intact. We suggest to buy this stock for an upside target of 540 keeping the stop loss near 405.

11:30 (IST) 8 Aug 2022 Hindustan Aeronautics rallies 5%, hits new high on strong business outlook

HAL share price jumped 5% intraday on strong business outlook. In the year 2022-23, defense budgets and revenues for defense contractors are expected to remain largely stable or increase, as military programs continue to be critical to national defense

11:29 (IST) 8 Aug 2022 Nifty, Sensex firmly in green

Benchmark indices trading firmly in green. Sensex is up 274.30 points or 0.47% at 58662.23, and the Nifty up 64.70 points or 0.37% at 17462.20.

11:28 (IST) 8 Aug 2022 Gold prices edge lower

Gold prices edged lower after solid U.S. jobs report last week boosted the prospect of aggressive interest rate hikes by the U.S. Federal Reserve, lifting the dollar and Treasury yields. Spot gold was down 0.1% at $1,772.27 per ounce, as of 0303 GMT, after dropping 1% in the previous session. U.S. gold futures eased 0.1% to $1,790.

11:17 (IST) 8 Aug 2022 Titan rises 1% after company’s Q1 profit surges 3800%; should you buy, hold or sell?

Rakesh Jhunjhunwala stock Titan rose in early trade on Monday after the company posted robust numbers for the quarter ended June 2022. Net profit of Titan Company rose 3,825% to Rs 785.00 crore in the Apr-Jun quarter, as against Rs 20 crore during the corresponding year-ago quarter. Titan’s net sales rose 198% to Rs 8,975 crore during the quarter under review, up from Rs 3,004 crore during the same quarter in the previous year. Titan share price jumped 1% to hit an intraday high of Rs 2,475 on BSE. Analysts remain bullish on the stock and see up to 28% upside going forward.

Read full story

10:40 (IST) 8 Aug 2022 Buzzing stocks

One 97 Communications (Paytm) has posted consolidated loss of Rs 645.4 crore for the quarter ended June FY23, widening from loss of Rs 381.9 crore in same period last fiscal. Revenue from operations grew by 88.5% to Rs 1,679.60 crore during the same period.

10:09 (IST) 8 Aug 2022 Power stocks gain

BSE Power index rose 1 per cent led by the JSW Energy, Siemens, ABB

10:09 (IST) 8 Aug 2022 Nifty, Sensex trading firmly in green

Benchmark indices were trading firm in the volatile session led by the power, auto and metal names. The Sensex was up 106.98 points or 0.18% at 58494.91, and the Nifty was up 23.40 points or 0.13% at 17420.90.

09:57 (IST) 8 Aug 2022 Auto, metals stocks gains

Auto, metal stocks are trading firmly in green. Meanwhile, PSUs weaken most

09:47 (IST) 8 Aug 2022 HPCL shares tank 5%

HPCL share price tanked 5% due to losses on marketing margins. Its Q1 loss was the highest ever in a quarter at Rs 10,196.94.

09:46 (IST) 8 Aug 2022 Paytm share price jumps 2% despite Q1 net loss widening to Rs 645 crore; should you buy, hold or sell?

Paytm share price rose 2 per cent on Monday to Rs 799 on BSE after the company reported a consolidated loss of Rs 645.4 crore for the quarter ended June 2022, against a loss of Rs 382 crore logged in the corresponding quarter of the previous fiscal. The digital payments platform’s consolidated revenue for the June FY23 quarter came in at Rs 1,679.6 crore, an 89 per cent growth compared to Rs 891 crore reported in Q1 FY22. The contribution of margins to revenues increased to 43 percent of revenues from 35 percent in the previous quarter i.e. Q4 FY22.

Read full story

09:45 (IST) 8 Aug 2022 Nifty needs to hold above 17250, expect D-St to move in narrow range; check stocks to buy

Equity benchmark indices closed on a positive note last week. During the week, the Reserve Bank of India raised its key policy rates by 50 basis points to 5.40% which was in line with expectations. Sensex settled at 58,388, up 818 points or 1.40% while the broader Nifty index finished at 17,397, up 239 points or 1.4%. RBI kept a hawkish stance after delivering a half-point hike interest rate and maintained its forecasts for economic growth (GDP) at 7.2% on a positive note and inflation at 6.7% in the year ending March 2023. Sentiments were also boosted on account of Brent crude falling to a 6-month low, encouraging domestic economy data, good quarterly results and strong FIIs buying interest. Among the global markets, Asian, Europe and US Markets gained 1-3%. Cement, tyre and paint stocks gained as owing to a fall in oil prices. Impressive July auto sales data lifted auto stocks.

Read full story

09:40 (IST) 8 Aug 2022 BPCL shares fall 4%

BPCL share price slides 4% after company reports weak Q1; posts Rs 6,148 net loss

09:34 (IST) 8 Aug 2022 Nifty gainers, losers

M&M, Hindalco Industries, Titan Company, Tata Motors and Tata Consumer Products were among major gainers on the Nifty, while losers were BPCL, SBI, SBI Life Insurance, ONGC and UltraTech Cement.

09:21 (IST) 8 Aug 2022 Nifty, Sensex open flat

Indian indices opened flat amid weak global cues. The Sensex was up 46.94 points or 0.08% at 58434.87, and the Nifty was up 14.90 points or 0.09% at 17412.40. About 1366 shares have advanced, 737 shares declined, and 108 shares are unchanged.

09:20 (IST) 8 Aug 2022 SBI share price drops 2.8% after April-June quarter results disappoint; Should you buy, sell, or hold?

State Bank of India (SBI) share price dropped 2.8% on Monday morning as investors reacted to the lender’s April-June quarter earnings. SBI had reported a 6.7% on-year drop in net profit to Rs 6,068 crore on Saturday, missing street estimates owing to lower NIMs. Analysts further highlighted that SBI’s other income was impacted significantly due to MTM losses during the quarter. After disappointing earnings, domestic brokerage firm Edelweiss has downgraded the stock to ‘Hold’ and also cut its target price. However, not everyone is turning bearish on the stock with analysts at Kotak Securities and LKP still advising investors to buy the stock. SBI share price was trading at Rs 515 per share.

Read full story

09:15 (IST) 8 Aug 2022 Despite signs of caution, there are positive catalysts like oil prices tumbling 10%, FIIs turning net buyers

Key benchmark indices are likely to see a gap down opening in Monday trades, in tandem with weakness in other Asian gauges after US markets closed lower on Friday. If the weakness in Asian markets persisted during the course of the trading session, traders back home would take the opportunity to book profits as the markets had risen sharply in the previous week. The biggest negative catalyst is that the US yield curve has steepened, indicating signs of recession which would further worsen the sentiment across the global equities. Last week’s strong US jobs report further bolsters the case for the Federal Reserve to continue its aggressive policy tightening path. Despite the signs of caution, there are some positive catalysts like oil prices tumbling 10% last week, and FIIs turning net buyers of local equities in all the 5 trading sessions last week and buying shares worth Rs 6,992 crore.

~ Prashanth Tapse – Research Analyst, Senior VP (Research), Mehta Equities

09:14 (IST) 8 Aug 2022 Indian markets likely to open on a negative note

Indian markets are likely to open on a negative note today tracking weak global clues after a stronger-than-expected US jobs report on Friday raised the prospects of the Fed maintaining its aggressive monetary policy. Domestic markets ended higher on the back of gains in IT and BFSI stocks, which were partially offset by losses in auto and energy stock as the RBI increased repo rates by 50 bps, which was on expected lines. US markets ended mixed amid release of better-than-expected macroeconomic data.

~ICICI Direct

09:08 (IST) 8 Aug 2022 Benchmark indices trading flat in pre-opening session

The Sensex was up 9.27 points or 0.02% at 58397.20, and the Nifty was down 50.20 points or 0.29% at 17347.30.

08:56 (IST) 8 Aug 2022 Continue with a stock-specific trading approach

Nifty has been taking a breather after the sharp surge and it’s healthy. It’s more of a time-wise correction so far as it’s still holding around the upper range of the consolidation zone. A decisive close above 17,400 would further fuel the momentum towards the 17,700-17,800 zone else range bound move would continue. On the downside, the 16,800-17,150 zone holds major support. Since we’re seeing rotational buying across sectors, participants should continue with a stock-specific trading approach and utilise dips to add quality names.

~ Ajit Mishra, VP – Research, Religare Broking

08:46 (IST) 8 Aug 2022 Reliance to hold its 44th AGM on August 29

Mukesh Ambani’s Reliance Industries announced the date of its forty-fifth Annual General Meeting (AGM) as August 29, 2022. The meeting will take place at 2 pm through video conferencing. The company has fixed August 19 as the record date for the FY22 dividend, which might be declared at the AGM. It has also fixed Monday, August 22, 2022 as the “cut-off date” for the purpose of determining the members eligible to vote on the resolutions set out in the notice of the AGM and to attend the AGM, according to a regulatory filing to the stock exchanges.

08:46 (IST) 8 Aug 2022 Crude Oil price slides

Oil prices dropped and were hovering near multi-month lows, as recession fears hurt demand outlook and data pointed to a slow recovery in China’s crude imports last month. Brent crude futures dropped 74 cents, or 0.8%, to $94.18 a barrel by 0039 GMT. Front-month prices hit the lowest levels since February last week, tumbling 13.7% and posting their largest weekly drop since April 2020. U.S. West Texas Intermediate crude was at $88.34 a barrel, down 67 cents, or 0.8%, extending losses after a 9.7% fall last week.

08:45 (IST) 8 Aug 2022 Petrol and diesel price August 8: No change in fuel cost; Check prices in Delhi, Mumbai, other cities here

Petrol and Diesel Rate Today in Delhi, Bangalore, Chennai, Mumbai, Lucknow: The price of petrol and diesel on August 8, was left untouched by OMCs once again. Prices have held steady for 75 days now across the country, except in Maharashtra. Pieces were cut in Maharashtra when the state government announced a cut in value-added tax (VAT) on petrol by Rs 5 a litre and by Rs 3 a litre for diesel earlier last month. The cut in VAT is likely to cost Maharashtra’s state exchequer Rs 6,000 crore on an annual basis. For the rest of the country, prices have been steady since May 21 when Finance Minister Nirmala Sitharaman announced a cut in excise duty on petrol by Rs 8 per litre, and Rs 6 per litre on diesel.

Read full story

08:27 (IST) 8 Aug 2022 Stock specific action likely in SBI. Paytm

“We can see some action in the stocks which posted earnings after market hours on Friday including SBI, One97 Communications, FSN E-Commerce, HPCL, Marico, BPCL etc. Earning today include companies such as Adani Ports, Bharti Airtel, Power Grid, Torrent Power, JK Tyre etc. On the technical front, Immediate support and resistance in Nifty 50 are 17200 and 17500 respectively. Bank Nifty immediate support and resistance are 36500 and 37500 respectively.”

~Mohit Nigam, Head – PMS, Hem Securities