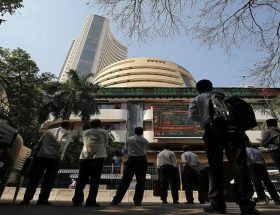

Nifty, Sensex tank more than 1%; here’s what is dragging share market today

Indian equity markets slumped on Monday amid weak global cues. S&P BSE Sensex was down more than 600 points or 1.08% to sit just above 59,000 while NSE Nifty 50 index was down close to 200 points or 1.10% to hover above 17,550. Bank Nifty was down more than 1.5% while India VIX gained 4% and breached 19 levels. According to analysts, dollar index surge and hawkish US Fed commentary might be behind today’s profit booking. Additionally, the minutes of the Reserve Bank of India’s policy meeting indicated more interest rate hikes in the coming months which spooked investors.

Also Read: DreamFolks IPO opens Wednesday, 24 Aug; check price band, grey market premium, issue size, bidding details

“Indian equity markets are witnessing profit booking after a vertical rise. The profit booking can be attributed to weak global cues as the dollar index surged amid hawkish US Fed commentary. Technically, the Nifty slipped from the psychological hurdle of 18,000 as most of the momentum indicators were showing an overbought reading,” said Santosh Meena, Head of Research, Swastika Investmart Ltd. adding that “the overall structure is still bullish where 17,500 is an immediate support area while 17350/17150/17000 are sacrosanct support levels therefore traders and investors may buy the dip in a scattered manner in the range of 17500-17000.”

Dollar index surges

Note that the dollar index is back above the 108 level, while the US 10-year yield hovers at 2.99 per cent on concerns over global growth slowdown and US Federal Reserve’s tightening weighed on investors’ sentiment. Fed Bank of Richmond President Thomas Barkin said on Friday the central bank was resolved to return inflation to its 2 per cent target, even if that meant risking a US recession. All eyes are now on Fed chair Jerome Powell’s speech on the economic outlook on Friday. Market participants may use his speech to clarify recent US Fed commentary and to reset expectations for the future pace of rate hikes.

“Markets continue to slide on global cues, continuing Friday’s trend. The overall market has seen a steep rise of ~17% since mid-June, despite tepid Q1-FY23 results. Forward earnings estimates for Nifty have declined by c. 15% till now, post June results. The Nifty is now trading at around 22x trailing earnings, which is fully valued. It is likely that the markets will blow off some steam and take a breather for some months. The markets will consolidate while FPI inflows resume, commodity prices decline and inflation comes off due to good monsoons,” said Vineet Bagri, Managing Partner, TrustPlutus Wealth India.

Also Read: Tata group stock gearing for gains, charts show; share price may rally 14% in 3 months

Wait for retracement around 17,000 before entering market

According to Rahul Goud, Research Analyst – Equity Research, CapitalVia Research, benchmark indices fell for a second session on Monday with information technology and banking sectors leading the way, following a severe decline in US markets on Friday. “Rising dollar index, which has reached a new five-week high as a US Federal official signaled the probability of continuing aggressive monetary tightening, is weighing on market mood. Global markets are also quite concerned about rising inflation. We advise traders to wait for a retracement around the nifty 17,000 level before entering the market,” Goud added.

(The recommendations in this story are by the respective research analysts and brokerage firms. FinancialExpress.com does not bear any responsibility for their investment advice. Capital markets investments are subject to rules and regulations. Please consult your investment advisor before investing.)